Make or Buy Analysis: A Key Decision-Making Tool in Project Management | PMP Guide

Published:

Updated:

In the realm of project management, one of the key strategic decisions a company faces is whether to produce a product or component in-house or to procure it from an external supplier. This process is known as Make-or-Buy Analysis, and it plays a critical role in determining how a company allocates its resources, controls costs, and maintains quality.

In the context of the PMP (Project Management Professional) certification, make-or-buy analysis is essential for project managers as it influences not only cost management but also time, risk, and overall project scope. This blog will explore the core elements involved in make-or-buy decisions and how project managers can utilize this analysis for optimal results.

Key Takeaways

- Make or Buy Analysis Defined: This critical decision-making tool helps companies determine whether to produce a product in-house or purchase it from an external supplier, impacting cost, quality, and delivery.

- Key Factors to Consider: When performing make-or-buy analysis, companies must assess production costs, material availability, delivery times, quality control, and potential risks.

- Cost Savings and Strategic Focus: Make-or-buy analysis can help businesses reduce costs and focus on core competencies by identifying the most efficient option.

- Risk Management: The analysis helps companies mitigate risks such as delays, quality issues, and supply chain disruptions by considering internal and external capabilities.

- Industry Examples: From Apple producing its own chips to Boeing outsourcing Dreamliner parts, real-life examples show how businesses apply make-or-buy analysis in various sectors.

- PMP Relevance: Make-or-buy analysis is a crucial tool for project managers preparing for the PMP certification, as it directly influences project cost, quality, and time management.

Key Factors in Make-or-Buy Analysis

A successful make-or-buy decision hinges on several factors. Below are the critical components to evaluate during this process:

1. Production Costs

At the heart of any make-or-buy analysis lies a comparison of the costs. This involves evaluating direct production expenses, such as labor and materials, as well as indirect costs like overhead, transportation, and storage. If the internal production cost exceeds the cost of purchasing the product from an external supplier, outsourcing becomes a more favorable option.

In the context of project management processes, especially those aligned with the PMBOK (Project Management Body of Knowledge), the make-or-buy decision is part of the procurement management planning process. This helps ensure that all procurement activities align with the project's schedule, budget, and quality requirements.

2. Material and Equipment Availability

In-house production requires access to the right materials and equipment. If the necessary resources are scarce, expensive, or unavailable, it might make more sense to procure the product from an external source that specializes in those materials. Furthermore, if the organization lacks technical expertise in producing the component, outsourcing can ensure quality and cost-efficiency.

3. Lead Time

A project's timeline is another crucial factor. If your internal team can produce and deliver the product or service faster than an external vendor, keeping the production in-house is advantageous. However, if the company faces capacity constraints that delay production, outsourcing might be necessary to meet deadlines and prevent project delays.

4. Quality Control

Maintaining high-quality standards is essential. If the internal team is capable of ensuring superior quality, then making the product in-house is ideal. On the other hand, outsourcing to a specialized vendor with a track record of high-quality production can safeguard standards, particularly when expertise is required.

5. Risk Assessment

Every make-or-buy decision carries inherent risks. Internal risks may include delays, workforce issues, or quality lapses. External risks might stem from supplier reliability, delivery delays, or potential intellectual property (IP) concerns. Evaluating and mitigating these risks is crucial in making a well-informed decision.

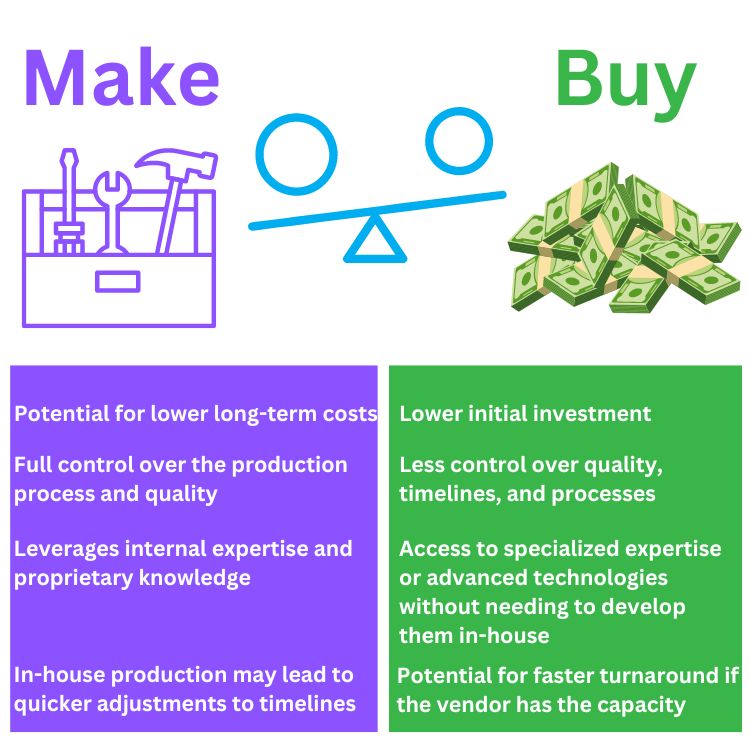

Make-or-Buy Analysis: Pros and Cons

| Factor | Make (In-House Production) | Buy (Outsourcing/Procurement) |

|---|---|---|

| Cost | Potential for lower long-term costs Requires significant upfront investment in facilities, materials, and labor |

Lower initial investment May result in higher long-term costs due to supplier markups or contract renewal rates |

| Control | Full control over the production process and quality Can ensure proprietary techniques or technologies are protected |

Less control over quality, timelines, and processes Risk of intellectual property exposure |

| Expertise | Leverages internal expertise and proprietary knowledge Fosters innovation within the company |

Access to specialized expertise or advanced technologies without needing to develop them in-house |

| Lead Time | In-house production may lead to quicker adjustments to timelines No reliance on external vendor timelines |

Potential for faster turnaround if the vendor has the capacity May experience delays due to external supplier capacity issues or logistics |

| Risk | Risks related to production capacity, staff, and resource allocation High internal risk if equipment or technology becomes outdated |

Risk of dependency on suppliers Vendor risks like quality issues, delivery delays, or business stability |

| Flexibility | Allows for customization and flexibility in production processes Easier to align production with specific project needs |

Less flexible in responding to specific internal demands May involve complex contracts and negotiations for customization |

| Quality Control | Direct control over maintaining and improving product quality Better alignment with company standards |

Reliant on the supplier's quality standards and processes May require rigorous supplier vetting and monitoring |

| Capacity | May require significant expansion if the company lacks the capacity to meet demand Can limit the ability to scale quickly |

Access to scalable production without needing major capital investments Supplier constraints could limit capacity during peak periods |

| Long-Term Strategic Goals | Aligns with long-term goals by building in-house expertise Opportunity for innovation and strategic differentiation |

Allows the company to focus on core competencies while outsourcing non-core functions Aligns with cost-cutting and operational efficiency strategies |

| IP Protection | Easier to safeguard intellectual property when producing in-house No risk of third-party exposure |

Potential risk of IP theft or misuse Requires legal measures like NDAs to protect sensitive information |

This table provides a quick and clear comparison of the advantages and disadvantages of making a product in-house versus buying or outsourcing it from external suppliers. Project managers can use this framework to assess the best course of action based on their specific project needs.

Benefits of Make-or-Buy Analysis

Conducting a thorough make-or-buy analysis delivers several benefits, helping businesses optimize their operations and strategic goals. Key benefits include:

- Cost Savings: A well-executed make-or-buy analysis can identify the most cost-effective way of delivering a product or service, helping to reduce costs and boost profitability. Whether it's about cutting overhead through outsourcing or leveraging in-house efficiencies, cost reduction is a primary benefit.

- Resource Optimization: Businesses can better allocate their internal resources, focusing on their core competencies while outsourcing non-essential activities. This flexibility allows companies to redirect their efforts towards growth, innovation, or scaling operations.

- Strategic Focus: Make-or-buy decisions shape the broader strategic direction of an organization. By analyzing internal capabilities and external opportunities, companies can align their production choices with their long-term goals.

- Risk Mitigation: By carefully evaluating internal constraints and external vendor capabilities, businesses can avoid the risk of taking on too much or missing critical project milestones. Outsourcing, when done correctly, allows companies to focus on what they do best, while external vendors handle the rest.

- Competitive Advantage: A comprehensive make-or-buy analysis enables businesses to streamline their operations, lower costs, and enhance quality. This, in turn, provides a competitive edge by improving market responsiveness and customer satisfaction.

Industry Examples of Make-or-Buy Analysis

The make-or-buy analysis typically happens during the planning phase of a project. This analysis is crucial for determining whether it is more cost-effective and strategically sensible to produce a particular item internally (make) or to purchase it from external sources (buy). During this phase, project managers and their teams evaluate all relevant factors such as cost, capacity, expertise, and time constraints to make an informed decision.

To illustrate the practical application of this analysis, here are examples from three distinct industries:

- Manufacturing Industry: A valve manufacturer is struggling to meet demand due to limited internal production capacity. After conducting a make-or-buy analysis, the company decides to outsource production to a third-party supplier. This allows the company to meet demand, reduce production costs, and maintain high-quality standards, while protecting its IP with a confidentiality agreement.

- Software Development Industry: A software company is facing multiple project deadlines and lacks the internal capacity to develop a new application on time. The make-or-buy analysis shows that outsourcing the development to an external vendor offers a faster turnaround with competitive pricing, allowing the company to capitalize on market opportunities while focusing on core projects.

- Construction Industry: A construction firm is debating whether to purchase or rent heavy equipment for its projects. By conducting a make-or-buy analysis, they determine that renting provides the flexibility needed to manage fluctuating project demands while minimizing the costs of maintenance and underutilization of equipment.

Real-Life Examples of Make-or-Buy Analysis

1. Apple Inc. - Make or Buy Decision on Chip Production

Apple, one of the world's leading technology companies, faced a classic make-or-buy decision regarding its processors. Initially, Apple relied on third-party suppliers like Intel and Qualcomm for chips used in iPhones and MacBooks. However, to gain more control over performance, cost, and integration, Apple decided to design and produce its own chips, leading to the development of the A-series chips for iPhones and the M1 chip for MacBooks.

- Production Costs: By designing its own chips, Apple could reduce its reliance on third-party vendors and better manage costs through innovation and economies of scale.

- Quality Control: With its own chips, Apple optimized performance specifically for its products, achieving superior results in terms of speed and efficiency.

- Risks: The in-house production posed a risk as it required substantial investment in R&D and manufacturing capabilities, but the benefits outweighed the risks by providing Apple a significant competitive edge.

This decision highlights how Apple used make-or-buy analysis to strengthen its control over core technologies, enhance product performance, and improve margins.

2. Toyota - Make or Buy in Manufacturing

Toyota, the global automotive giant, is well-known for its lean manufacturing techniques, but even they must decide between making components in-house or buying them from suppliers. A notable example is the decision on whether to produce hybrid vehicle batteries internally or outsource the production.

Initially, Toyota outsourced its hybrid batteries from Panasonic. However, as demand grew and the need for innovation intensified, Toyota began producing its batteries in-house to have greater control over the technology and reduce dependence on external suppliers.

- Cost Consideration: While it was cheaper to initially outsource, Toyota realized that producing the batteries in-house would be cost-effective in the long run due to high demand and innovation requirements.

- Technology and Quality Control: Toyota gained full control over the battery technology, ensuring that its hybrid cars were equipped with high-quality batteries tailored to its needs.

This decision allowed Toyota to stay competitive in the growing hybrid vehicle market while also enhancing the reliability of their supply chain.

3. Boeing - Outsourcing of 787 Dreamliner Parts

Boeing's 787 Dreamliner project is an example where a make-or-buy decision had both successes and challenges. For the Dreamliner, Boeing decided to outsource the manufacturing of major components, including wings and fuselage sections, to various global suppliers, aiming to reduce production costs and shorten development time.

- Cost Savings: By outsourcing, Boeing was able to reduce immediate development costs and leverage the expertise of specialized suppliers.

- Risks and Issues: The decision to outsource parts to multiple suppliers led to significant delays and quality control issues, as the integration of different parts from various suppliers proved difficult. This led to increased costs in the long run due to delays and the need for rework.

While outsourcing initially seemed cost-effective, the complexity of integrating outsourced components led Boeing to reconsider its strategy and bring more production back in-house for future projects.

4. General Motors (GM) - Electric Vehicle (EV) Batteries

General Motors has made a strategic decision to invest heavily in producing its electric vehicle (EV) batteries in-house. As the EV market grows, the ability to control battery technology and costs has become critical to maintaining competitive pricing and innovation.

- Cost: By manufacturing its batteries in-house, GM aims to lower production costs as EV demand increases.

- Risks Mitigation: In-house production reduces reliance on external suppliers, mitigating risks related to supply chain disruptions and giving GM greater control over the quality and performance of its batteries.

This decision allows GM to stay competitive in the EV market while ensuring innovation in battery technology and controlling production costs.

5. Leasing vs. Buying a House - A Personal Finance Example

When it comes to housing, individuals and families often face a decision between leasing (renting) a home or purchasing one. This scenario mirrors a classic make-or-buy analysis, where the decision is whether to "buy" the use of a home from a landlord or "make" an investment by purchasing the home and taking on ownership responsibilities.

- Cost Consideration:

- Leasing: Lower upfront costs, such as a security deposit and first month's rent, compared to the significant down payment required for purchasing a home. Monthly rental payments, however, do not contribute to asset ownership.

- Buying: A home purchase requires a large initial investment (down payment, closing costs) and ongoing mortgage payments, but over time, these payments build equity in an appreciating asset.

- Flexibility:

- Leasing: Offers flexibility, especially for individuals who expect to move frequently or who are uncertain about long-term housing needs. Renters can relocate with ease once the lease ends, without worrying about selling a property.

- Buying: Homeownership is a long-term commitment. While it offers stability, selling a house can take time and involve additional costs (e.g., realtor fees, renovations).

- Risk Consideration:

- Leasing: Renting limits financial exposure to real estate market fluctuations. The risks of depreciation or market volatility are absorbed by the landlord. Renters, however, face the possibility of rent increases or eviction.

- Buying: Homeownership carries risks, particularly market-related risks like falling property values. If the home depreciates, the owner might lose money upon selling. Additionally, homeowners are responsible for maintenance and repair costs, which can be unpredictable.

- Long-Term Financial Impact:

- Leasing: Over the long term, leasing does not provide any return on investment or build financial assets. Rent payments contribute to a service (housing) but do not accumulate equity.

- Buying: Over time, a home can appreciate in value, providing financial returns when sold. As the mortgage is paid off, the owner enjoys the benefit of owning a valuable asset outright.

Outcome:

- A family that values flexibility and lower upfront costs might choose to lease, especially if they anticipate moving frequently or are not ready for a long-term investment.

- Conversely, individuals seeking long-term stability and equity-building opportunities might opt to buy, knowing that the initial investment and risks will eventually be offset by owning a property that could appreciate in value over time.

This make-or-buy decision framework allows individuals to weigh short-term affordability against long-term financial benefits, while also considering personal risk tolerance and lifestyle preferences.

Conclusion

In project management, particularly when preparing for the PMP certification, understanding make-or-buy analysis is indispensable. This decision-making process allows companies to determine the most efficient way to source products or services, whether through internal production or external procurement. By factoring in costs, availability, quality, and risks, companies can optimize their operations, gain a competitive advantage, and ensure strategic alignment with their broader business objectives.

Make-or-buy analysis is not just about cost-cutting but about making informed decisions that improve overall project outcomes, ensuring timely delivery, quality, and profitability.